Dodd-Frank step down limits went live for the core products on March 15. The rest go live first of the New Year. On the first limits rule read, many of us came away thinking it is pretty much a kitten. On the surface there wasn’t anything earth shattering. On closer inspection there was one real gotcha:

CL (WTI) step down limits.

This is going to catch firms flat footed.

Remember the WTI debacle in 2020 where oil prices went severely negative? Step down limits is very likely a knee-jerk reaction to that event.

What Are Step Down Limits?

Step down limits have been around for ages. K3 was already doing step downs for cattle futures. Essentially you have three spot limits instead of one. That means that your limits solution has to track your position against three spot start dates and three limits. For example:

- Spot 1 Starts Jan 18: 600 lots

- Spot 2 Starts Jan 26: 300 lots

- Spot 3 Starts Jan 28: 200 lots

We then saw a handful of step down limits under MiFID II. And now WTI. What was somewhat an obscure edge case is now front and center in one of the most liquid commodity contracts.

For CL the limits are:

- Spot Start 1: 6,000 lots 3 days prior to the last trading day.

- Spot Start 2: 5,000 lots 2 days prior to the last trading day.

- Spost Start 3: 4,000 lots 1 day prior to the last trading day.

Did you notice that window? CL steps down in a three day period. If you are calculating limits on a daily basis you might be in for some painful evenings toward the end of month. How? Well, many firms wait for their FCM files at the end of day to assess their limits positions. This is a setup for a very bad surprise.

Also, don’t forget. Exchange all month and single month accountability levels of 20,000 and 10,000 respectively are still in force. As is the 6,000 lot spot limit on the exchange.

Don’t Sweat It: K3 Is Ready With 2 Offerings

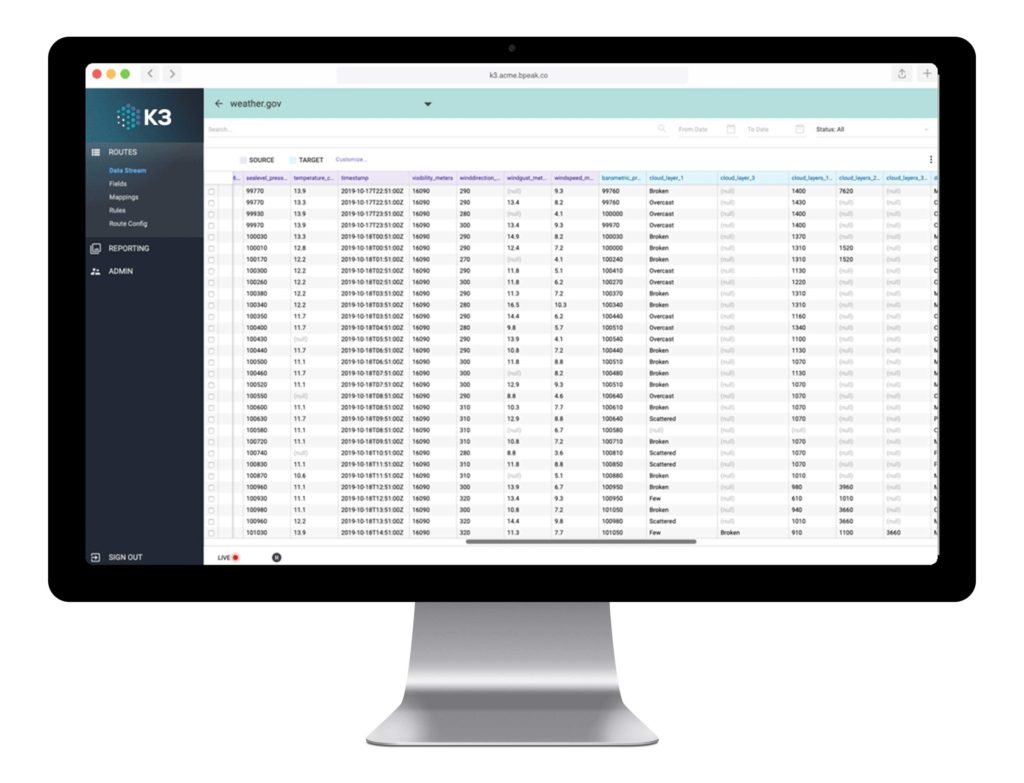

Offering #1: K3 Atlas

If you already have your own limits process, use Atlas. K3 Atlas is an API for all the reference data that goes into limits. Atlas downloads limits from nearly every exchange and regulator including the step down limits. It alerts for data changes. It has all the spot start dates. We have exchange deltas for all options. Everything is organized behind a clean REST API. It means you can keep using your own limits solution without having to worry about keeping up with daily changes from all the exchanges. This could not be easier to incorporate into your own limits process.

Offering #2: K3 Limits

Of course, you can also license the full solution with K3 Limits.

With actionable data and custom visualizations, you get the power of our cloud data store for exchange, MiFID 2, and Dodd-Frank. Moreover, K3 Limits is the only solution with certified exchange connections to provide you with real time limits on every product including CL.

That’s the thing about CL. Intraday limits. The step down is over a really short window of only a few days. The stakes are simply too high for a daily limit calc. K3 is the only commercial limits solution offering real time limits and exchange certified connections.

If you are interested in seeing Atlas, we’d be happy to set you up with a trial key. Likewise if you are looking for a fully supported limits solution we are more than happy to show you how it all works.