This is the first blog post in a five-part series about the futures and options trading environment. The series looks at how firms can manage trade data more effectively to support automation, growth, and compliance, regardless of the size of your firm.

In a world where we can video chat with friends around the world with the click of a button, it makes no sense that people are still manually entering trades. A common scenario: a trader executes a trade on ICE, yet no trade message appears from the exchange. The root cause typically lies in one of several intermediary layers between the exchange and your internal systems.

If you already understand ICE data flows, use this as a quick reference. If you are new to futures trading, start with the data supply chain overview and the glossary below. Then read the next post, ‘ICE trade capture unpacked’, where we explain how futures data moves from start to finish.

Understanding the data supply chain

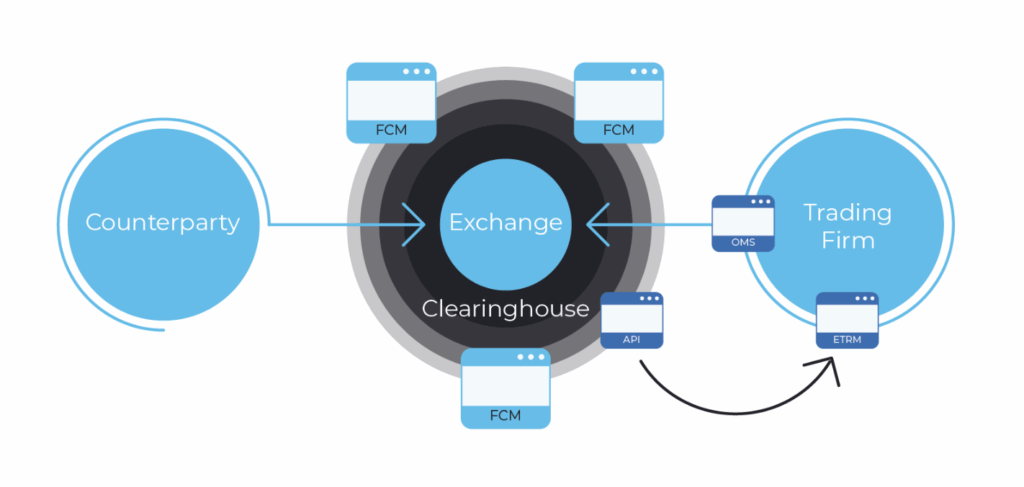

In enterprise futures trading, data moves through a supply chain. The trade data supply chain is the automated pathway that moves, for example, your ICE trades from execution to your internal risk systems. When functioning correctly, this process takes only seconds. When it breaks down, traders resort to manual entry – a persistent problem in modern futures trading.

This flow starts when a trader clicks Buy or Sell and ends when the trade message reaches an internal risk system. Each link in this chain must work for trades to appear correctly downstream.

The process starts when a trader executes a trade on WebICE (OMS). The trade data moves from the exchange to the trader’s clearing account at the FCM, then through the ICE Trade Capture API (TC API). The TC API is the technical interface that delivers real-time trading activity feeds to market participants. This API serves as the critical bridge between exchange-executed trades and your firm’s to the firm’s risk system. This usually happens within seconds.

Everything before the TC API is managed by the exchange. The final step, from the TC API to the company’s internal risk system, depends on how each firm is set up. Most firms use software to connect to the TC API and store trade data in their systems. Without that connection, traders have to enter trades manually. Yes, that still happens today.

Even with software in place, problems can occur. Some are straightforward, but many come from the layers of intermediaries in the data supply chain.

Key terms for ICE Trades

- Order Management System (OMS): The trading interface used to send orders to an exchange. WebICE is ICE’s OMS platform.

- Futures Exchange: The marketplace for trading futures and options.

- Clearinghouse: The central counterparty that manages credit and margin risk. Risk shock absorber for the market in case participants have financial stress.

- Clearing Broker (aka Futures Clearing Merchant FCM): An entity that collects margin from participants on behalf of Clearinghouse.

- ICE Trade Capture API (TC API): Technical interface through which participants can receive a feed of their trading activity.

- Trading Risk Management System (ETRM, CTRM, TRM): Enterprise software used by various trading firm groups to manage a trade from start to finish.

Checklist: finding every ICE trade

ICE trade capture for listed trades. These are electronic futures and options trades made through WebICE.

- FCM-hosted OMSs must have FIX sessions set up in the client firm’s name.

- API IDs need permission to pull trades from each market.

- API IDs also need permission to pull security definitions.

- Clearing accounts must be configured to pass trades through the ICE TC API.

If all above items are correct but trades still missing, check TC API connection software

ICE trade capture for broker-executed trades. These are trades executed off-screen through a broker.

- All the steps for listed trades apply.

- FCMs must enable allocations for every broker, legal entity, and clearing account combination.

- The system connecting to the TC API must request allocations data.

- Allocations data should be normalized so that it looks like a regular trade.

ICE trade capture for User-Defined Strategies (UDS). These are strategy trades made up of multiple underlying futures or options.

- This is all about technology. UDS security definition messages flow in real time through the TC API.

- These messages must be used to enrich and identify UDS trades.

ICE trade capture for block trades. These are broker-executed trades that exceed a minimum volume threshold.

- FCMs must enable block trades for each combination of broker, legal entity, and clearing account.

These are the main checks needed to ensure ICE trade data flows correctly through the TC API. Some firms face particular challenges due to different trading patterns, legal structures, or technology footprints.

Visibility across all your ICE trades and beyond

Gain complete visibility across all your ICE trades and beyond. BroadPeak Trade Capture delivers real-time, unified trade data from ICE, CME, Nodal, and other exchanges directly to your E/CTRM, risk, and analytics platforms. Built specifically for energy and commodity trading firms, BroadPeak provides direct exchange connectivity, including full ICE Trade Capture API integration, intelligent automation for all trade types, clean, structured, normalized data, and faster access to reliable insights.

Learn more about BroadPeak Trade Capture →