Perspectives

Insights

Explore our latest insights on the issues shaping energy and commodity trading, and what they mean for traders, risk, and compliance leaders

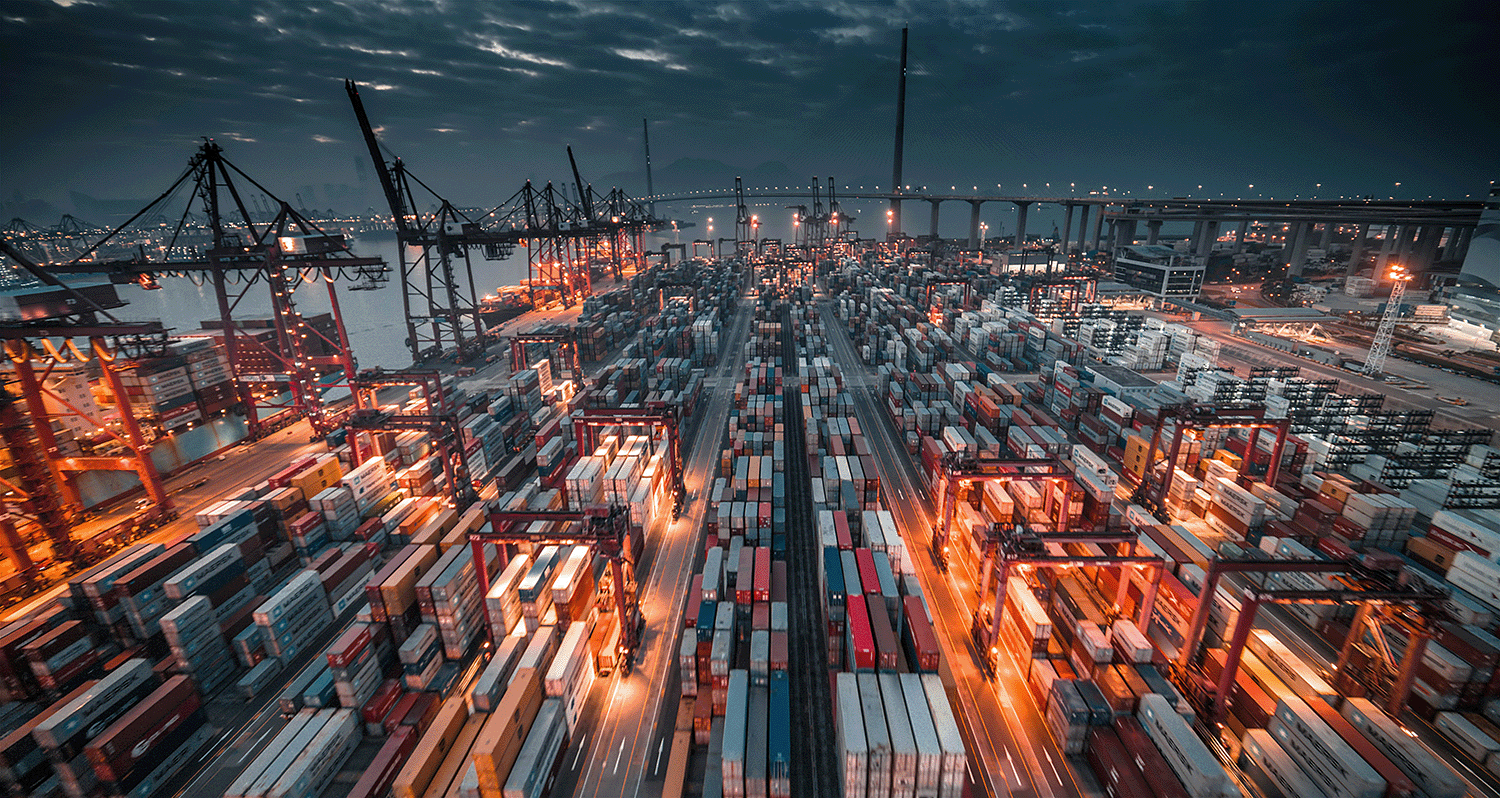

- Blog

Data and workflow across energy and commodity trading

Reliable trade data and coordinated workflows help energy and commodity traders navigate fragmented markets and...

- Whitepapers

Position limits: managing exposure across exchanges, OTC, and bilateral contracts

Real-time position limit monitoring and cross-venue position aggregation are no longer operational enhancements....

- News

BroadPeak renews SOC 2 Type 2 certification

Achieving SOC 2 Type 2 again underscores our longstanding commitment to operational excellence....

- Blog

Trade surveillance: Why data quality determines success

Trade surveillance programs succeed or fail based on data quality, not surveillance logic or alert...

- Whitepapers

Streaming ETL is not always the answer

Not every data pipeline needs streaming. Learn when batch, streaming, or hybrid ETL works best....

- Blog

Why AI projects fail in energy and commodity trading

Most energy and commodity trading firms are testing AI right now but not getting results...

- Blog

BroadPeak’s Trade Surveillance solution gaining traction

Q&A exploring why BroadPeak’s Trade Surveillance solution is gaining traction across energy and commodity firms...

- Blog

How to put ETL to work in energy and commodity trading

Between 2016 and 2018, 90% of global data was created. Trading firms run on data....

- Whitepapers

Data integrity in energy and commodity trading

Integrity matters in trading, risk, and compliance. The same goes for your data....

- Blog

Hybrid position limit monitoring for energy and commodity trading

Should position limit monitoring use exchange data or end-of-day data for complete, reconciled records? The...

- Whitepapers

The trade data supply chain: Exchange to enterprise

How does trade data flow from a trader through exchanges, clearing and FCMs?...

- Whitepapers

Data integration and orchestration for energy and commodity trading

How does data orchestration and integration help energy and commodity traders connect systems, automate workflows,...