General Data Flow for Futures Exchanges

This is Part Three of our five-part series on demystifying the trade data supply chain. Be sure to read Part One and Part Two for all the information you need on ICE trades and tracking.

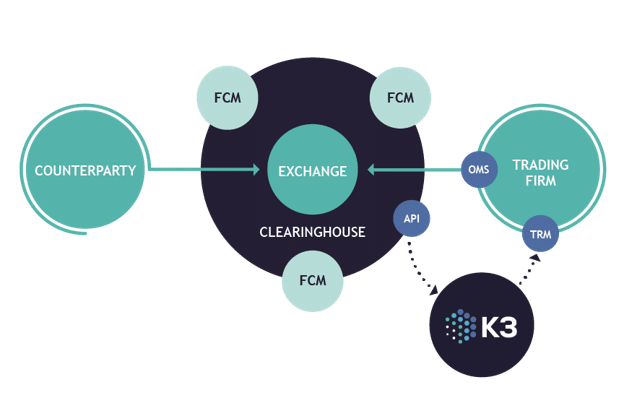

Before we jump into the specifics around the CME, let’s remind ourselves of the general plumbing for exchange futures trading. Save the diagram below and share freely. It should help multi-disciplinary teams see how each of their respective pieces of the trade data supply chain are connected.

The blue circles are technologies being used. The green circles are companies involved.

Use the glossary below to clarify jargon and acronyms. If you have any questions, please reach out and, let us know.

A trader uses software (an OMS) to send an order into the exchange to buy. The exchange has a matching engine that matches the buy order with another trader’s sell order, which results in a trade.

Trade data is then sent from the exchange to the clearinghouse to run risk checks. This ensures that the companies involved in the trade can fulfill the obligations around that trade. After the risk check, the trade is then “cleared” by the clearinghouse.

The trade then makes its way to the FCM for margin and fees collection at the end of the day, before being made available to the trader’s firm via an API.

The final leg involves software picking up trades from the exchange’s API and sending them to a risk system, so that the trader who initially submitted the order can see an updated position. All of this happens in milliseconds.

The alternative is to manually enter a trade…clickity click click.

Glossary for CME Trades

If you are unfamiliar with trading industry jargon, these links should help you digest the flow above:

Order Management System (OMS) – Software that “screens” traders’ orders, and is used to interact with the Exchange

Futures Exchange – Marketplace for trading futures and options

Clearinghouse – Risk shock absorber for the market in case participants have financial stress

Clearing Broker (a.k.a. Futures Clearing Merchant or FCM) – An entity that collects margin from participants on behalf of Clearinghouse

CME STP API (STP) – Technical interface through which participants can receive a real-time feed of their trading activity

Trading Risk Management system (ETRM, CTRM, TRM) – Enterprise software used by various trading firm groups to manage a trade from start to finish

Over the Counter (OTC) – Trading between two parties directly. Could be executed via a broker

Application Programming Interface (API) – Data handshake between software applications

A Primer on CME Markets

There are three venues for CME trades: with humans the old school way, electronically with software, and a mixed-mode.

Floor – Open Outcry

Prior to electronic markets, this is how futures trading was done. People stood on the floor, with hand signals and yelling. If you have not seen Trading Places, then please stop everything and do that now.

Globex – Electronic Marketplace

Globex is CME’s electronic marketplace, running 24/7 around the world.

Trading can occur with people clicking buy/sell on a screen, or even with software sending in orders based on price signals (i.e. algo trading).

Clearport

Clearport is a facility for OTC trades to be submitted into the CME clearinghouse. This allows firms to consummate a trade outside the exchange, but then register the trade with the clearinghouse to then be cleared. This means the trading firms aren’t at risk in case their counterparty defaults.

After Globex launched in 1992, you can imagine what happened. Most of the trading went electronic. Now Globex covers almost everything you can trade on CME, whereas open outcry is limited to rates and agricultural products, although given COVID not all floor operations are fully open.

CME Futures/Options contracts are all listed on individual “exchanges,” which were once independent but all now reside under the CME Group.

- CME: Chicago Mercantile Exchange (FX, Financial Indices)

- CBOT: Chicago Board of Trade (Agriculture)

- NYMEX: New York Mercantile Exchange (Energy)

- COMEX: Commodities Exchange (Metals)

Products on all these markets can be traded on Globex, but also traded OTC and then cleared via Clearport. There are many regulatory nuances around OTC cleared trades that we are not touching on here.

For example, only certain special trade types are available. You will hear terms such as: block trades, EFS, EFRP, etc. Just know that these are trades are consummated outside the exchange, but then given up for clearing. And if you repeat that sentence in a meeting, you will sound smart.

One Stop Shop - Data as Legos

All this under the hood complexity must mean that data is complex too, right? Nope.

You connect the STP API, and you get nicely structured data from the exchange or clearinghouse. The data helps you easily identify different venues and trade types.

All trade data from the CME is represented as a future or an option in a standard way. Like legos, that makes stacking and storing easy. There are worries about cracking your code when traders do complicated things.

To be fair, there are two other broad data structures that can come through CME STP. One is for Fixed Income trades via Brokertec. The other is for Bilateral trades that you could ask your broker to send via STP. This way, you can get all your trades through a single pipe. If your company trades these products, you will need to have a step to normalize everything so you can…you guessed it…stack the legos.

Back to (the) Futures…

Representing data in a standardized way means you can easily handle complexity. Traders can execute a structured strategy trade composed of multiple futures and options, but the data from STP flows with each individual piece of that trade as a single future or option. You can unite them with data, like a common trade ID.

The STP API does allow firms to request a single trade message for complex trades instead of the broken out standard components. Usually, this is because some traders are used to seeing things that way. If you ask your tech teams to follow suit, you can expect delays every time a new lego shape comes through the API. Or traders will be asked to only trade the structures that have already been coded for.

It’s hard to stack custom lego shapes. Rectangles and circles are you friends.

So the data is straightforward. How about the nerdy data plumbing?

Whereas most trade data plumbing runs on the FIX protocol, the STP API is a simple https/REST API with data in an XML message (FIXML to be specific). This is the same kind of modern technology footprint you might use to get records from Salesforce. Wait…futures trading just got a modern facelift?

Kind of. Except we are in a world of large firms (ahem…banks) that have invested heavily in the FIX Protocol, which is the only on-ramp they have for ingesting trades to their systems.

So the CME Group fronted STPs REST API with a FIX protocol layer and everyone was happy. However, it’s yet another step in the process and adds complexity to workflows. Most of the mysterious issues we have seen with home-grown and vendor CME trade feeds comes down to using the FIX layer instead of the simple REST API.

Common Issues

- Some trades come through as an amendment the first time we receive them.

- Likely you have traders using an OMS hosted by an FCM. These trades are executed in the broker’s name and then allocated to your firm’s clearing accounts afterwards. Thus, the first time you see them, they have an amended status (TransTyp = 2).

- Likely you have traders using an OMS hosted by an FCM. These trades are executed in the broker’s name and then allocated to your firm’s clearing accounts afterwards. Thus, the first time you see them, they have an amended status (TransTyp = 2).

- We receive multiple versions of the same trade repeatedly where no data has changed. Our traders have not requested any cancelations or amendments.

- Because the STP API will serve up all exchange and clearinghouse events, if your FCMs have any processes “touching” trade data, or moving between internal accounts, those actions will all generate a message on the STP API. Thus, you need to guard against duplicating transactions in your systems.

- Because the STP API will serve up all exchange and clearinghouse events, if your FCMs have any processes “touching” trade data, or moving between internal accounts, those actions will all generate a message on the STP API. Thus, you need to guard against duplicating transactions in your systems.

- We have technical issues from time to time. Can the CME STP send us older trade data?

- CME STP offers 31 calendar days in history requests. This is really helpful in case of issues or if your tech teams need to test something against real production data.

- CME STP offers 31 calendar days in history requests. This is really helpful in case of issues or if your tech teams need to test something against real production data.

- Can we get a parallel feed of our trading activity?

- Being a REST API at its core, you can reuse production credentials to make parallel API calls from a test environment.

- Being a REST API at its core, you can reuse production credentials to make parallel API calls from a test environment.

- Does my FCM need to do anything?

- Simple – your FCM just needs to register your clearing accounts in CME Account Manager and they will be eligible to flow through the STP API.

- Simple – your FCM just needs to register your clearing accounts in CME Account Manager and they will be eligible to flow through the STP API.

- You mentioned that trading floor. What is it like down there?

- Did you watch Trading Places yet?

Here to Help

Missed our earlier posts in this series? Don’t worry—Part One, “Where Are My Ice Trades?” and Part Two, “Tracking Trade Execution And Data Workflow,” can get you up to speed in minutes.

Want to keep the learning going or get answers in real-time? We’re here for you. Take advantage of our complimentary office hours—yes, really—or subscribe to our blog below and receive all upcoming posts.

Office Hours with Vivek

Office Hours with Vivek

Sign up now for a complimentary meeting with our Exchange trade expert for real-time TRM help.

The Latest Updates

Trade Data Supply Chain Demystified Part 2: ICE Trade Capture Unpacked

Tracking Trade Data from an Order to Instant Risk/PnL Part Two of Five In this second post in our series of blogs discussing the futures

Will the Real Gamestop Please Stand Up

Will the Real Gamestop Please Stand Up True story. My college friend Ed. Maybe I shouldn’t use his real name….meh, his name is Ed. Anyway,